Q1. Jimmy, we’re now seeing both Democrats and Republicans trying to use the federal tax and spending bill to gain political support. Democrats say the new law will force people off their health insurance and cut Medicaid. But now Republicans are starting to go on offense.

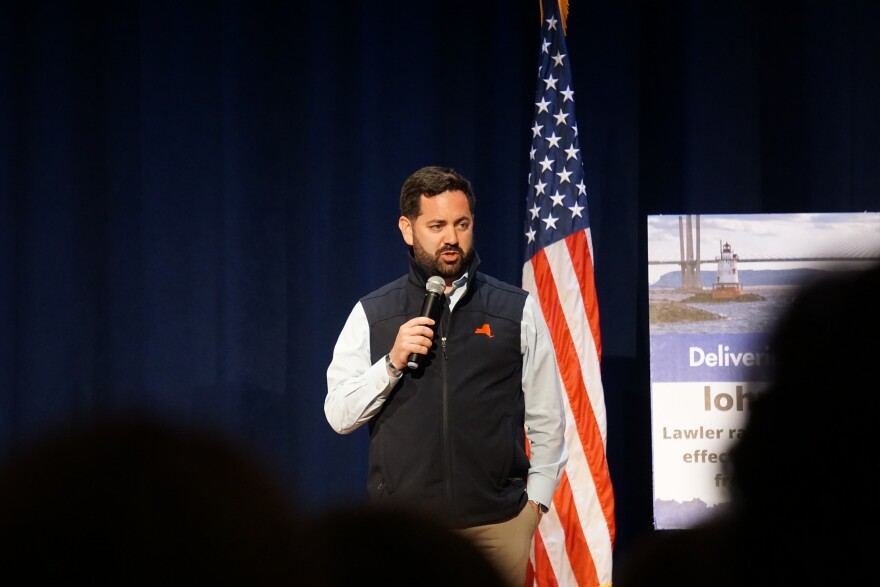

You wrote recently about Congressman Mike Lawler, who did an event about what he and other Republicans call the “big beautiful bill.” What was his message?

It was a pretty simple one. Lawler notes that the bill includes tax cuts for millions of New Yorkers, including most of his constituents. It also renewed cuts in a 2017 law that were due to expire at the end of this year. Those include lower tax rates, and some larger deductions.

That’s let Republicans say that this bill, quote, “prevents the largest tax cut in history.” But most of the relief is already in place.

2. Is there anything in there that’s new, that people will see in their tax returns next year?

Yes, there are a bunch of things. Let me go through a few.

First, the bill increases the child tax credit. Up to $2,200 from $2,000.

Second, many people over age 65 will get a new deduction that’s designed to cover their Social Security earnings.

Third, people who get paid with tips will have some of that income be exempted from taxes.

The fourth deduction is really important to New York. It’s called the State and Local tax deduction, or SALT.

3. Tell me why that’s particularly important in this region.

Before 2017, people in high-tax states like New York, New Jersey, Connecticut and Massachusetts were able to deduct their state and local taxes from their federal income. Let me explain that. If I have federal income of, say, $150,000 dollars, but I pay $5,000 in property taxes and $10,000 in state income taxes … I don’t have to pay taxes on my taxes. I subtract the $15,000 in state and local taxes, and I only pay federal income taxes – which for most people are between 20 and 25 percent – on the remaining $135,000 dollars.

The 2017 law put a limit on that SALT deduction. Taxpayers were only allowed to deduct $10,000. In places with high property taxes, like the New York City suburbs … that was a real hit for folks.

4. So what does this law do about SALT?

It increases the limit to $40,000 from $10,000. So it’s quadrupled for most taxpayers – people who report less than $500,000 of income.

Lawler ran on this issue when he won his seat in 2022. And he threatened to not vote for the legislation unless SALT was addressed.

Last week he told his constituents that he delivered on that promise. But there were people … who weren’t happy. Take a listen.

[Lawler: With the passage of the one big beautiful bill, we’ve quadrupled the SALT deduction.

Crowd: booooo

Lawler: All of you will benefit

Crowd: bullshi….]

The problem is the other provision of the bill. They include cuts to Medicaid and changes to food assistance programs. Several people at the Lawler’s event last week held signs protesting those changes.

5. What do Democrats say about this bill?

They say it will hurt people. Governor Hochul has held several events in Republican areas to talk about the Medicaid cuts. Hospitals in New York say the new law will reduce their funding by $8 billion dollars. That could lead to thousands of layoffs.

I talked with Paul Tonko, who represents the Capital Region, about this. He says the tax cuts … aren’t worth it. They’ll increase the deficit and force those Medicaid cuts. And they’ll mostly benefit the wealthy. Take a listen.

[Tonko:] I just think the outcome for the taxation policy, the tax policy could have been far better. We wouldn't have to blow a deficit of 4 trillion into our, uh, into our budget. Into our economy. Uh, we wouldn't have had to cut essential programs if we had done this correctly.

So there’s a clear counter-argument there.

6. Will it resonate?

That’s the .. I guess $5 trillion question? Republicans are betting that money in people’s pockets will outweigh cuts to social programs. There’s some difference in when cuts take effect, though, so it’s not clear exactly WHEN people will feel those health care changes.

The only thing I can predict is that both parties are going to be talking about this A LOT in the next 15 months.

All right, that’s WNYC’s Jimmy Vielkind. Thanks so much.